A macroeconomic turnaround worth noting

Argentina is turning the corner. After last year’s setback, the economy is projected to grow 5.5% in 2025 (BBVA Research), fueled by stronger consumption and investment as restrictions on capital and currency gradually ease.

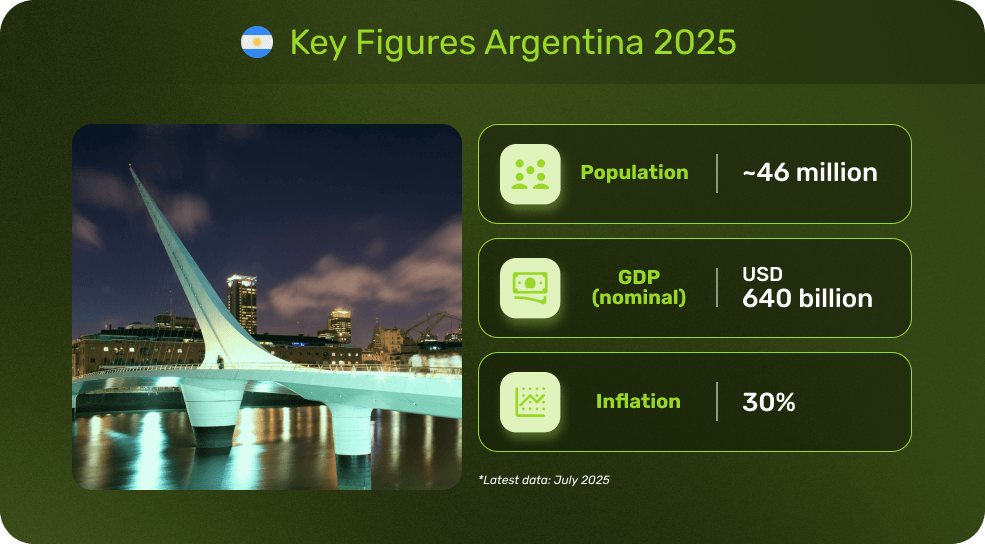

The inflation story is also shifting. Expectations for 2025 now sit around 30%, a dramatic improvement compared to the triple-digit rates of 2023 (BBVA Research). The IMF stresses that continued fiscal discipline will be key to sustaining this positive trend.

Easing FX controls & renewed confidence

For international businesses, the liberalization of the FX market is a milestone. With most capital and currency restrictions lifted, companies can now plan for a more flexible peso, smoother dividend repatriation and easier cross-border operations (Real Instituto Elcano).

Argentina’s digital commerce pulse: opportunity for global merchants

E-commerce in Argentina shows no signs of slowing down. PCMI reports that 8 out of 10 adults are already shopping online, making digital commerce part of everyday life. In 2024 alone, the market generated around US$33 billion in sales (PCMI).

What’s even more remarkable is penetration: 18% of total retail sales in Argentina happen online, nearly double the regional average, with only Chile posting similar levels.

Looking forward, the sector is set to keep climbing: projected to expand by 14% between 2024 and 2027, reaching close to US$50 billion in value.

Digital wallets are at the center of this growth, now accounting for 38% of all e-commerce transactions in Argentina. MODO, with 31.6% market penetration, leads, while Ualá follows at 20.6%. Public‑bank-backed options like Cuenta DNI (14.4%) and BNA+ (12.2%) also play significant roles (PCMI). Meanwhile, Ualá serves around 6 million customers, growing 13 % year‑on‑year between 2023. (FintechNews).

Also, shoppers are mobile-first: in 2023, 70% of online purchases were made via mobile devices, compared to just 30% on desktop (Trade.gov).

Why local payments matter for global merchants

For global merchants, Argentina is a textbook example of why localization drives success:

- Local currency builds trust: pricing in pesos reduces friction, avoids confusion, and lowers cart abandonment.

- Alternative Payment Methods (APMs) expand reach: wallets, bank transfers, and BNPL resonate with local shoppers.

- Credit card penetration is still limited in Argentina, but digital access keeps rising fast. According to the Central Bank’s Financial Inclusion Report (2024), 66.4% of adults now hold an account (whether bank or digital payment account). This rapid shift shows how Argentinians are embracing digital rails, making wallets and bank transfers the true drivers of financial inclusion beyond traditional cards.

- Local acquiring improves approval rates: routing payments locally helps avoid unnecessary declines and lowers costs compared to international acquirers.

What this means for global merchants

If you’re considering expansion, Argentina in 2025 offers a compelling mix:

- An economy on the rebound: growth returning, inflation easing, FX reforms unlocking opportunities.

- Digitally native consumers: mobile-first, wallet-savvy, and eager for flexible payments.

- Clear room for conversion optimization: merchants who embrace local rails will see better approvals, higher conversion and larger average order values.

Success case: Tiendamia

Working with Bamboo, Tiendamia was able to strengthen its local payment strategy, adding pesos checkout and top digital wallets. This combination not only improved approval rates but also gave shoppers a smoother, more familiar payment experience. It’s a clear example of how the right partnership can help global merchants adapt quickly and grow in Argentina.

👉 Want to learn more? Click here to read the full success case.

In Summary

Argentina in 2025 combines a recovering macroeconomy with one of the most advanced digital payment landscapes in Latin America. For global merchants, the opportunity is clear: go local and you’ll go further.

At Bamboo, we provide the infrastructure to make that possible helping global players not just enter Argentina, but thrive in it. And as in every market where we operate, our local teams are on the ground to guide you through the context, share insights and work side by side to solve challenges. Because payments are never just about rails, they’re about understanding markets and making them work for you.