Think about this: you’re shopping online, paying a bill or sending money to a family member late at night. Rather than waiting minutes (or even until the next banking day) your payment is confirmed in seconds. That’s the shift Bre-B is bringing to Colombia.

Developed by Colombia’s Central Bank, Bre-B is a real-time payment rail designed to make money movement faster, simpler and more inclusive.

What Bre-B brings

Bre-B is Colombia’s new interoperable, always-on rail for low-value payments and transfers:

- Always on. Payments clear in seconds, 24/7/365.

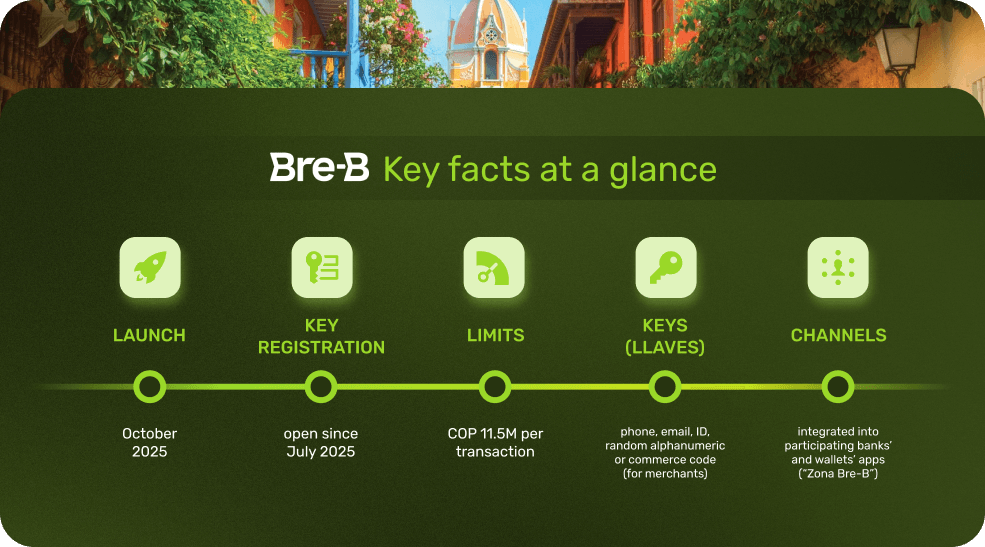

- Simple to use. Instead of typing long account numbers, people use an alias (llave), a phone, an email, an ID or a randomly generated key.

- Trusted by design. Bre-B lives inside the digital channels of banks and wallets. Users approve payments where they already trust.

- Low-value focus. Each transfer is capped initially at COP 11.5M. Institutions may apply lower limits or daily counters.

- Traceable. Every transaction includes a reference, making reconciliation clearer for businesses and consumers alike.

If you know Pix, you know where the region is heading

Brazil’s Pix is the clearest proof of how fast an instant payment rail can transform a market. Launched in 2020, it became the country’s most-used payment method within a few years, reaching over 150 million users and processing billions of transactions each month.

Pix didn’t just accelerate payments, it redefined expectations. Consumers started to demand “instant” as the default and institutions realized that interoperability was no longer optional.

That momentum is spreading across the region. Mexico launched SPEI for instant transfers, Chile is rolling out SPI and Peru has announced its own interoperable system. Bre-B is Colombia’s answer bringing the same 24/7, alias-based logic to a market of 50 million people. For global companies, this isn’t a niche upgrade; it’s part of a regional shift that’s setting a new baseline for how money moves in Latin America.

Why Bre-B is a structural change in Colombia

By design, Bre-B is mandatory for all licensed financial institutions in Colombia. Banks, neobanks and wallets like Nequi are required to integrate and accept transfers through it. This mandate changes the playing field:

- From fragmentation to interoperability. Where institutions once operated in silos, now they must connect to a shared national grid.

- From limited reach to nationwide access. Any Colombian — regardless of bank or wallet — will be able to send and receive funds once their provider is connected.

- From business hours to always-on. Transfers are processed instantly even at night, on weekends or during holidays.

For consumers, this means greater freedom and less friction.

Why this matters for global merchants

If you operate or plan to expand in Colombia, Bre-B is more than just another payment method. It’s an opportunity to:

- Offer a familiar approval flow within trusted banking and wallet apps.

- Provide an experience that works any time of day.

- Simplify processes with standardized references and instant confirmations.

- Reach nationwide coverage through one single integration.

The bottom line: Bre-B isn’t only about speed. It’s about giving your customers and partners a better, more reliable payment experience any time, any day.

How Bamboo helps

At Bamboo, our role is to turn Bre-B’s potential into value for your business. We help you:

- Navigate local rules and institutional safeguards.

- Keep payment experiences simple and consistent.

All with the LATAM-native expertise and hands-on support you expect from us.

Bre-B is one example, but it’s not the last. As instant-payment schemes emerge across the region, Bamboo makes them accessible to global merchants early, so you can stay ahead of the curve and deliver the experiences your customers already expect.

Ready to explore how Bre-B, or the next instant rail, could fit into your Colombia operations?