Money20/20 USA once again brought together the global payments community and for Bamboo, it was more than just another event. It marked both a chance to engage with industry peers and a fitting moment to reflect on what’s been a milestone year for our team.

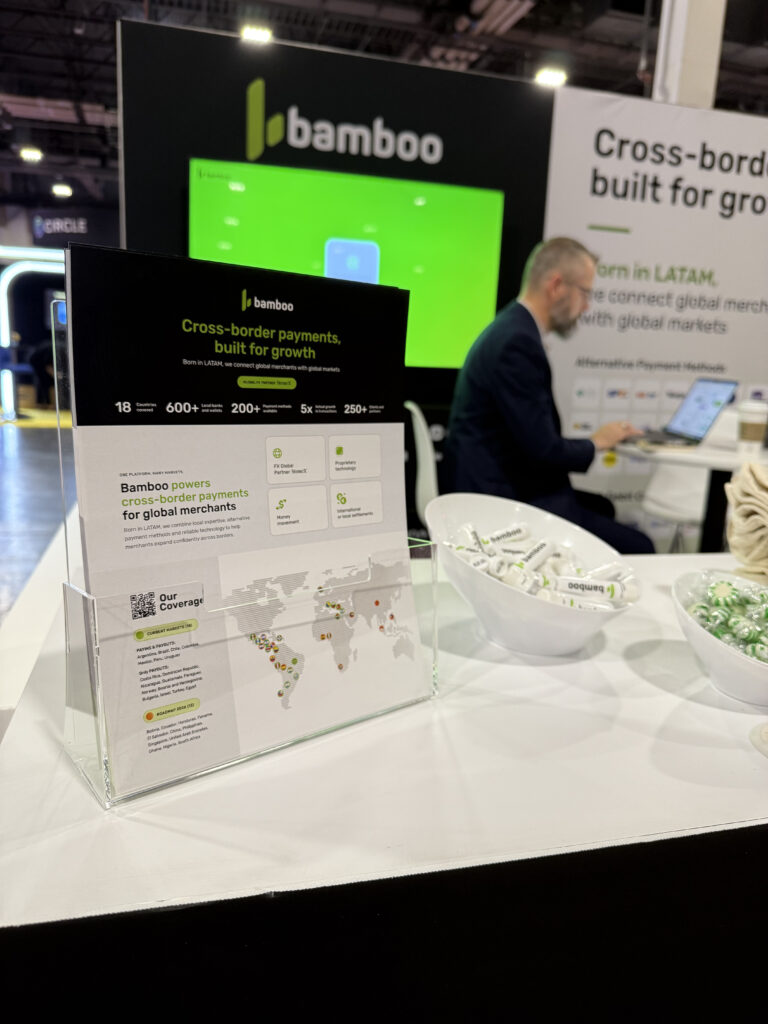

As an official sponsor, Bamboo had a strong presence on the show floor, hosting partners, clients and new prospects at our booth. Across three days of conversations, we shared how we’re helping global merchants connect with local payment methods, move funds instantly and grow in real-time economies. The event also allowed us to listen, to better understand how the market is evolving and where we can continue to add value.

A Space for Real Conversations

Our booth quickly became a meeting point, a place where strategy met opportunity. We welcomed existing partners who have been part of our journey, met new merchants exploring Latin America and beyond and had open discussions about trends shaping the future of payments.

We also brought along some of the Bamboo essentials, small but meaningful details that carried our identity and made every interaction memorable. Above all, it was a reminder of what makes these events valuable: genuine human connection.

Signals That Point to the Future

The conversations and sessions across Money20/20 reflected a clear direction for the payments industry, one that resonates strongly with Bamboo’s own trajectory. Latin America is increasingly viewed as a testing ground for global innovation, and the discussions in Las Vegas underscored how much the region’s progress is shaping what comes next.

Interoperability over fragmentation.

The industry is moving beyond isolated systems. Real-time networks and local rails are being designed to connect effectively, laying the groundwork for a more unified payments infrastructure, one that enables scale without losing local relevance.

Consumer-led innovation.

Across regions, users are defining what “good” looks like: faster, simpler and fully digital experiences. In Latin America, this pressure has accelerated adoption of instant payments, digital wallets and alternative methods that respond to local habits while meeting global expectations.

Regionalization as the new globalization.

Rather than relying solely on traditional global players, emerging markets are strengthening ties among themselves. Collaboration between Latin America, Africa and Asia is expanding, creating a south-to-south network of innovation that’s rewriting the global payments map.

Inclusion as a business strategy.

Financial inclusion is no longer a social initiative, it’s a growth driver. Companies are recognizing that reaching underbanked consumers and small businesses is not just the right thing to do, but also the most sustainable path to expansion.

Together, these signals point toward an industry that is faster, more inclusive and more connected — values that are deeply embedded in Bamboo’s mission.

A Year of Growth and Momentum

Money20/20 also served as a natural checkpoint to look back at how far we’ve come this year. So far in 2025, we’ve:

- Achieved 3.5× growth in total payment volume with 99.99% uptime.

- Expanded our coverage from 7 to 18 countries, extending Bamboo’s global reach.

- Welcomed StoneX as a strategic investor and global FX partner, a major milestone in our journey.

- Built new partnerships and onboarded incredible merchants across key industries.

- Grown our global team across 11 countries, adding new leaders and perspectives, all guided by our Manifesto.

These milestones reflect the same spirit we brought to Las Vegas: focused, collaborative and ambitious. And with one quarter still ahead, we’re not slowing down.

Looking Ahead

Our participation in Money20/20 reinforced a simple truth: the payments industry is transforming fast and Bamboo is evolving right alongside it. We leave this event with new connections, stronger partnerships and a clear sense of direction for what’s next, continuing to power cross-border payments built for growth.

Here’s to closing a strong year and building what’s coming next, together.